It is often believed that quantitative impact assessment or valuation is unsuitable for investor due diligence due to the data gaps, resource needs, and timeline for implementing a quantitative assessment. However, this is no longer the case. Investors increasingly use quantitative impact assessment and valuation approaches to inform their due diligence. This is a game changer in the way it informs investment decisions and creates impact.

Traditionally, investors start with an impact thesis which defined in the best case scenario a series of KPIs or requirements that are checked systematically for each deal. Those are however not directly comparable (e.g. GHGs, jobs creation, # beneficiaries, etc) or difficult to quantify (e.g. skills acquisition, health benefits, etc). Those indicators are usually tracked during the investment period and used for informing strategies for portfolio companies. However, due to the lack of comparability, relevance and comprehensive view of all impact drivers, it happens more frequently than we think that some investments do not deliver the expected impact or even result in negative impacts. Embedding impact valuation at the due diligence phase allows us to avoid those inefficiencies or gaps, offer more impact for society, and avoid some financial risks.

Valuing Impact supported the Southern Reconstruction Fund (SRF) in its due diligence process, starting first by testing and selecting impact methodologies to establish a robust process to follow afterward. SRF is a social impact fund committed to strengthening the resilience of the American South. Its Fund of Funds strategy focuses on capitalizing and catalyzing novel impact investment strategies that accelerate equitable economies, ownership, and outcomes while producing alpha returns. Investments that close the racial wealth gap, increase access and opportunity for Black and brown fund managers, and contribute to a more inclusive economy tend to produce more of the impacts we seek to achieve.

The eQALY impact valuation method was selected to be deployed on a few pilot organizations as part of a due diligence process. The eQALY method accounts for the change in well-being in the society, derived from any impact drivers, whether directly related to health or from economic outcomes such as change of income, wealth, education, and social costs, to name a few. The eQALY method is closely related to the concept of (W)health introduced by SRF:

“We define (W)Health as a person’s ability/freedom to fully engage their community and capital markets with their highest order of mental and physical facilities and the financial capacity to participate in and co-create capital markets, without bias or the unnecessary burden of systemic barriers.”

This is our society’s capital in its purest form, as this defines how long and well we live (well-being).

This eQALY or (W)health approach is a general impact valuation method, and its use goes beyond the due diligence process, as it informs portfolio companies’ strategies, active engagement strategies, funds’ strategies, reporting and communication, as well as engagement with stakeholders. It is great to raise awareness as well. Using such an advanced approach ensures the funds’ leadership and legacy.

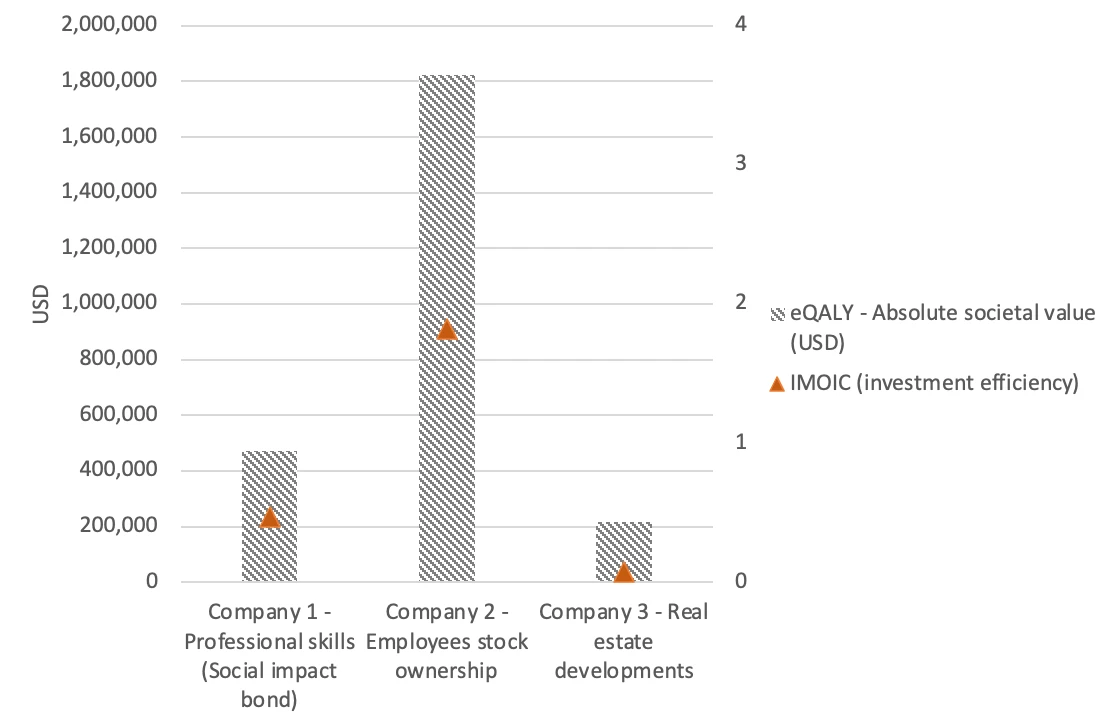

The pilot companies covered through the pilot phase were the following:

Company 1: Social Impact Bond oriented to professional skills acquisition of immigrants at work or to support education curriculum,

Company 2: Employee stock ownership program for companies with the black majority

Company 3: Real estate investments to support services and lower rents for under-served communities.

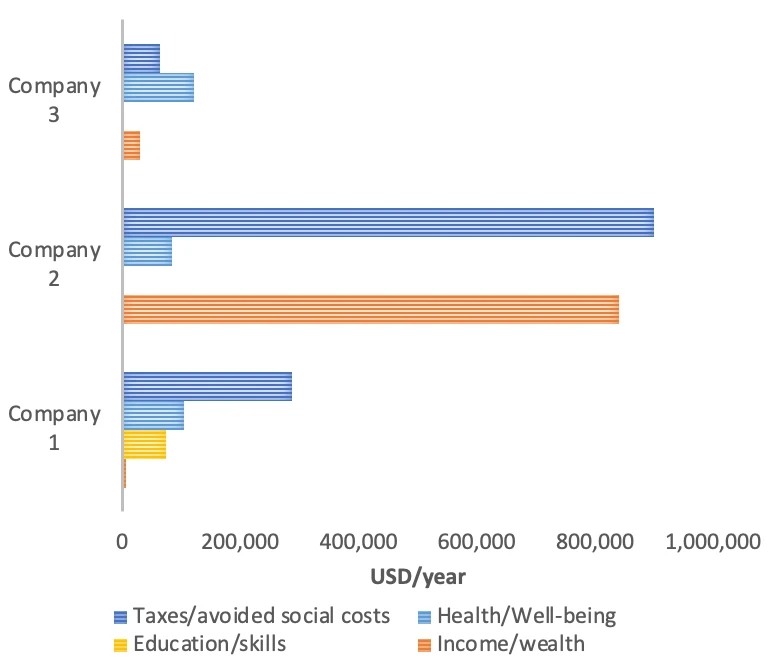

The challenge of due diligence is the data gaps, as the analysis needs to be delivered in a relatively short period of time and with little capacity to collect new impact data. Nevertheless, the methodology was successfully deployed, building on the existing companies documentation, dataset provided in the eQALY method (open-source) and complemented by a small literature review. Data gaps were addressed using secondary data and expert estimates involving SRF and stakeholders. Based on the impact thesis of SRF and its thematic and regional focus, we prioritize the pathways related to income/wealth, education/skills, health/well-being, and avoided social costs or taxes.

We developed an Excel tool based on the impact framework and methodology defined to allow non-experts to carry out assessments of deals to inform due diligence processes. This Excel tool encompassed a simple user interface to compare as many as 5 deals at a time and pulled from 12-15 data inputs per deal that are easily accessible without deploying lengthy survey or data monitoring systems.

Once the impact valuation results were obtained, we used additional metrics to compare the deals more easily, called the IMOIC or Impact Multiple On Invested Capital. The IMOIC is the ratio between the social value created over a specified period (typically 10 years) divided by the capital invested. This is a simple ratio that measures the efficiency of societal value creation per unit of capital invested.

The following results show both the absolute value created and the IMOIC ratio. We can see that company 2 has both the highest societal value and investment efficiency. However, when looking at company 3, which is about real estate investment, the investment efficiency is much lower than that of the other companies in relation to their absolute societal value. This might come from the fact that real estate investments are more capital-intensive than other activities. Despite the uncertainties, the long-term effect should be better captured, given that infrastructures usually have a long investment timeframe.

Looking more into the details of the drivers of impact, we can observe very different impact profiles across the companies. While company 1 (professional skills) allows the creation of significant value for the state in terms of avoided cost and social costs, company 2 (employees’ stock ownership) delivers much more impact in terms of income and wealth (thanks to the stock ownership) for the beneficiaries. Company 3 has a strong component of well-being, as the real estate program focuses on the social integration of different communities and services in the same neighborhood.

The results successfully supported the engagement with potential investees and the internal decision-making process at the fund. The tool created remains as a legacy of the project to support the fund on other potential deals in the future.

This case study taught us valuable lessons, including:

It is possible and practical: Impact valuation helps effectively in making pre-investment decisions in a very short period of time (usually less than 1-2 weeks).

Comparing capabilities is key to avoiding human biases: Without quantitative impact data, comparing deals and understanding their absolute impact is impossible.

Understand risk and opportunities based on the same method: Impact valuation provides a deep understanding of the most critical impact drivers at the deal level and highlights risks and opportunities to structure a deal on its material impact.

Impact scale-up opportunities are established from the due diligence phase: Realizing an early-stage impact valuation allows us to establish a strong foundation to manage an investment and collect the right data actively.

Using impact valuation for short-term decision processes, such as due diligence assessment, is increasingly common. Data gaps and timelines are no longer a barrier to moving forward in deploying such an approach, and we encourage all organizations to test and embed the approach, building on the resources shared by Valuing Impact.

Learn more about the eQALY method here!

The full case study is available on the IVH platform.