Impact measurement has matured quickly over the last decade. Many investors now track outcome KPIs, publish impact reports, and align with established frameworks. A recurring challenge remains: translating that impact information into investment decisions—fast enough for screening and diligence, and consistent enough to compare opportunities across a pipeline.

AI changes the time constraint. When paired with a robust impact framework and pre-defined valuation methods, teams can produce an initial, decision-ready impact valuation in about an hour. The goal is not perfect precision. The goal is a transparent estimate that is comparable across deals and easy to refine during diligence.

In this post, we outline the trends enabling this shift, the foundations required for credibility, and a practical (simplified) example based on a biochar case.

AI trends in impact assessment—and what they unlock

Three developments are accelerating impact assessment and making impact valuation usable earlier in the investment process:

- Natural-language interfaces for complex workflows. Impact analysis often sits across decks, technical notes, operating data, and third-party evidence. AI can synthesize those inputs, structure them, and convert them into standardized outputs—especially when guided by templates, clear constraints, and pre-defined valuation methods (drivers, KPIs, coefficients, baselines, horizon).

- Faster pathway mapping and hypothesis testing. Impact pathways (inputs → activities → outputs → outcomes → impacts) are essential, but building them repeatedly is slow. AI can draft pathways, identify missing links, and flag where assumptions are weak—so teams focus their expertise on what is material for valuation: attribution/additionality, baselines, durability, and the few coefficients that drive most of the result.

- Decision support, not just reporting. The core shift is time-to-decision. By translating impacts into a consistent unit (often monetary value), AI-enabled workflows let impact teams work at the pace of investment teams—bringing valuation upstream into screening and due diligence, producing transparent, comparable first-pass estimates and a clear set of diligence questions to refine them.

The result is a field that evolves from “measuring what happened” to “steering what should happen”—with impact valuation increasingly used to compare options, prioritize interventions, and shape strategy. This is particular relevant for pre-investment decision-making processes.

Impact framework, KPIs, and valuation: foundations still matter but timing is the key

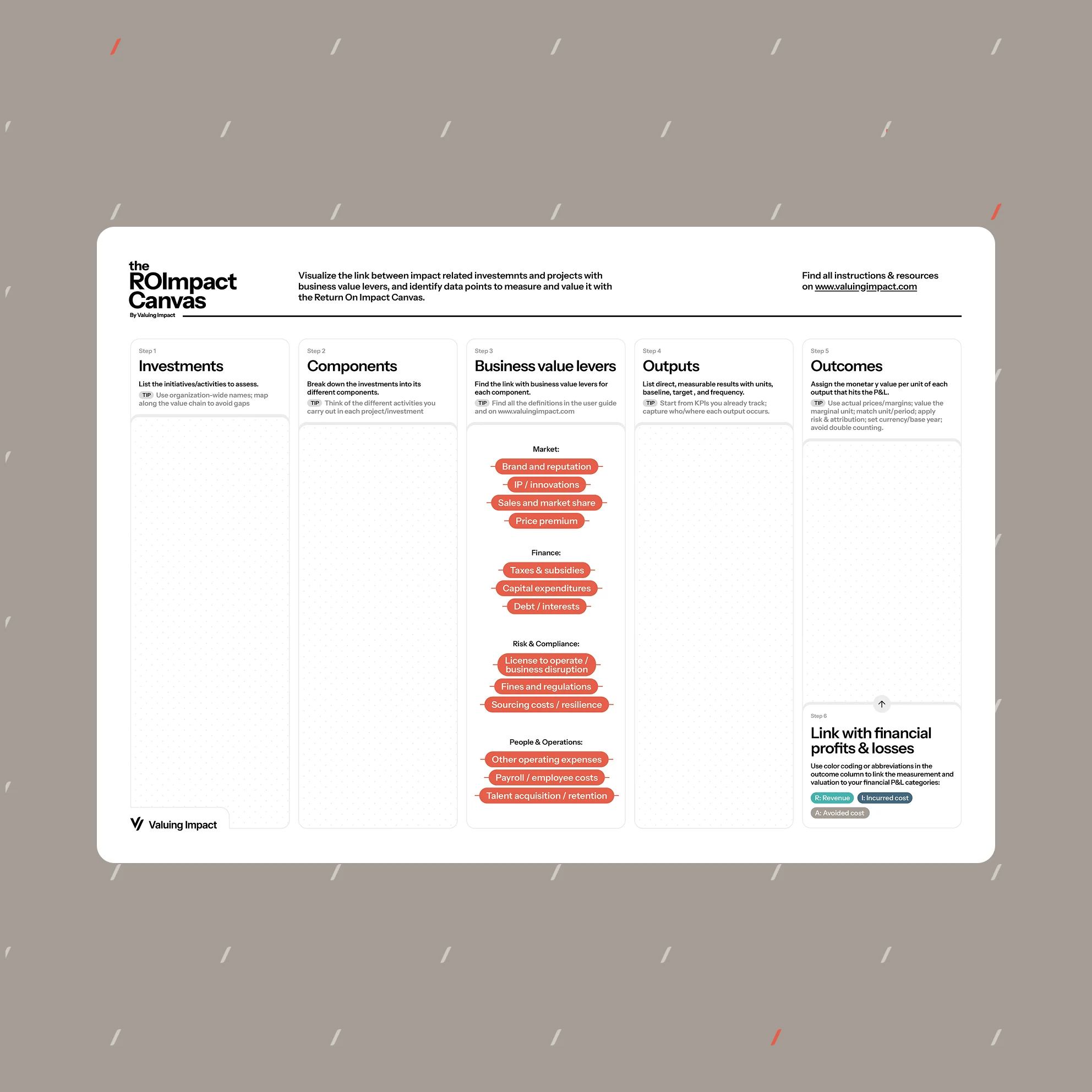

Speed only helps when paired with discipline. Credible valuation starts with an impact thesis (what change, for whom, and how), then an impact measurement framework and KPIs that are material, measurable, and comparable.

Valuation goes one step further by translating impacts into a consistent unit (often monetary value). That supports comparability across deals, consistent assumptions, and decision-useful outputs that can inform diligence, portfolio construction, and strategy.

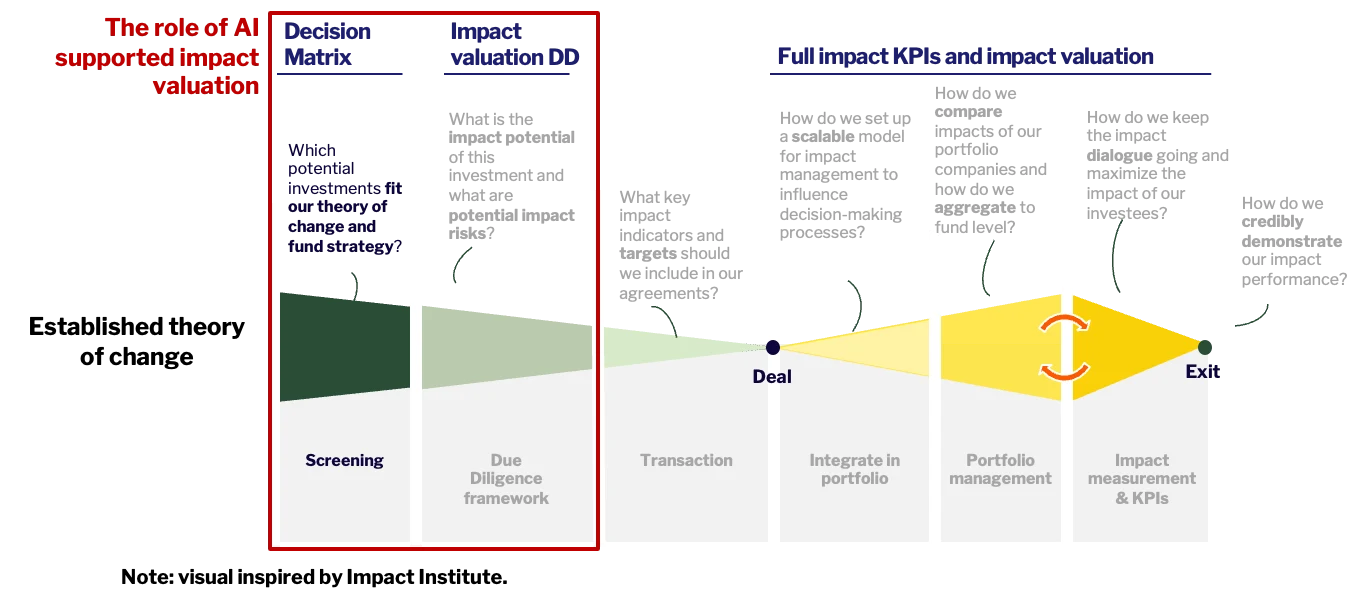

Historically, most organizations used impact valuation after investing—because doing it well requires time, data, and specialized expertise. The operational reality was clear: teams could not run a full valuation for every opportunity in the pipeline.

AI changes that constraint.

As illustrated in the investment journey visual below, AI-supported valuation can extend upstream into the earliest stages—screening and impact valuation due diligence—through tools such as a decision matrix and rapid valuation modules. This creates a step-change: instead of asking “How do we report impact later?”, investors can ask early on:

- Does this opportunity fit our theory of change and fund strategy?

- What is the likely impact potential—and what are the key risks?

- Which deals merit deeper diligence, and why? Which deals deliver the most value, per dollar of capital invested?

This is not about replacing expert judgment. It is about reducing the cost and time barrier so that impact valuation becomes a practical input to early decisions.

Turning valuation into a rapid screening workflow

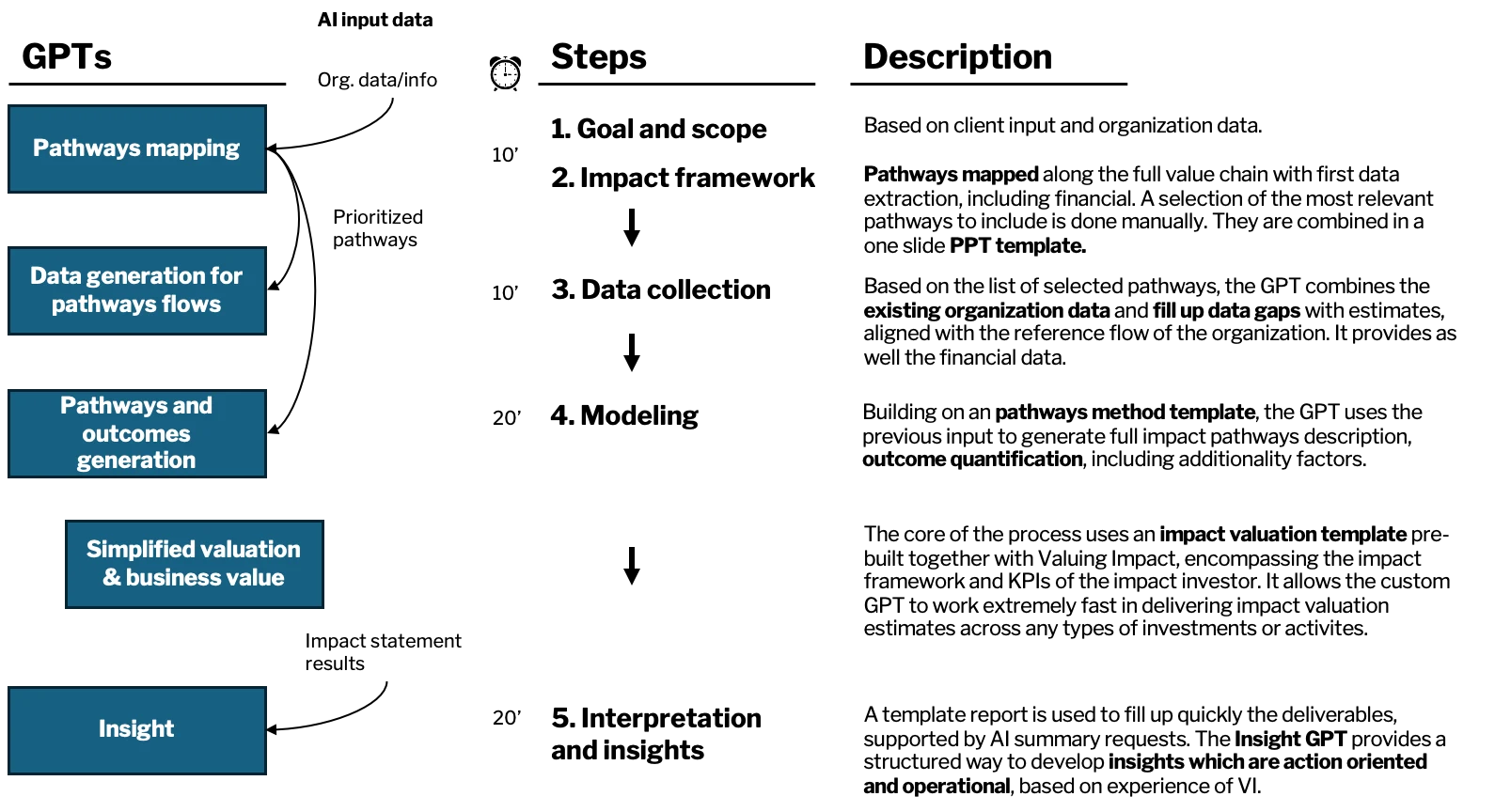

A full impact valuation can be detailed and resource-intensive. The goal of an ultra-fast AI workflow is different: produce a structured, transparent, and decision-relevant estimate that can be refined over time.

This requires five ingredients:

-

Designing the method foundation. Define the valuation logic in advance: impact drivers, KPI definitions, valuation coefficients, baseline scenarios, time horizons, and any required adjustments (e.g., attribution, additionality, drop-off).

-

Writing the right prompt (or building dedicated GPTs). Prompts are not just “questions.” They are instructions that define scope, guardrails, output structure, and what counts as acceptable evidence. The strongest implementations use dedicated GPTs for repeated tasks (e.g., pathway mapping, data gap filling, valuation computation, insight synthesis).

-

Setting the right context and input data. AI quality is highly dependent on context. The workflow must feed relevant organizational information (operations, geography, beneficiaries, unit economics), and clearly state what is known versus assumed.

-

Choosing the AI model for the task. Some steps benefit from fast summarization; others require deeper reasoning, sensitivity checks, and consistency across assumptions. Selecting an appropriate “thinking” mode matters—especially for valuation steps where small errors can cascade.

-

Analyzing and refining the results (human-in-the-loop). A rapid estimate must be reviewed. The objective is not perfect precision; it is transparent logic, traceable assumptions, and clear next questions for diligence.

The figure below (the “Ultra rapid AI enhanced impact valuation screening (1h)” workflow) summarizes how these steps can be completed in roughly an hour—moving from goal/scope to impact framework, data structuring, modeling, and actionable insights.

A practical example: biochar impact valuation, simplified but decision-ready

To illustrate what “ultra-fast valuation” looks like in practice, we use the simplified societal impact valuation for a biochar case, which is based on an innovative machine deployed in agricultural regions around the world.

The table organizes impacts into a small number of material drivers with explicit KPIs and valuation logic over a 10-year horizon. In this case, four drivers are highlighted. These corresponds to the impact framework and KPIs defined beforehand for the client:

- tCO₂e reduction/avoidance

- Income generated for workers/beneficiaries

- Air pollution reduction (PM₂.₅)

- Land restored / ecosystem uplift

Using the ultra rapid process based on AI (OpenAI in that case), we ran the analysis for one machine deployed in an Asian country. The total societal value over 10 years is estimated at ~156,800 USD as illustrated in the results table below. The Imapct Multiple On Invested Capital (IMOIC) is 3.1, which means that for each dollar of capital invested, this investment delivers 3.1 dollars of societal value. This can be used to benchmark various investments together, on the same basis, informing where to invest capital for the highest impact return.

| Impact driver | KPI (short name) | Biochar machine metric (per year) | Valuation (societal value, 10-year total) |

|---|---|---|---|

| tCO₂ reduction / avoided | CO₂ avoided (tCO₂e/year) | ≈ 55 tCO₂e/year avoided via biochar production & application (typical “rice mill” unit) | ≈ 82,500 USD → 55 × 10 × 150 USD/tCO₂e |

| Income generated for workers / beneficiaries | Net income (USD/year) | ≈ 20,000 USD/year additional net income (farmers’ added revenues 10–20k + partner facility ≥10k, rounded) | ≈ 20,000 USD → 20,000 × 0.1 (HUI) × 10 yrs |

| Other impact – Air pollution (updated: composting baseline) | PM emissions (kg PM₂.₅ net / year) | ≈ +67 kg PM₂.₅/year (composting baseline ≈ 0; biochar tech emits ~4% of “open burning” PM₂.₅ inferred from your ~96% reduction framing: (1,600/0.96)×0.04 ≈ 66.7) | ≈ −14,700 USD → 67 kg × 22 USD/kg × 10 yrs (negative because emissions increase vs composting) |

| Land restored | Land restored (ha) | 25 ha cropland receiving biochar annually (2 t/ha on ~25 ha) with assumed 5% uplift in ES value | ≈ 69,000 USD → 25 ha × 5,567 USD/ha/yr × 5% × 10 yrs |

| Total societal value (10-year) | ≈ 156,800 USD | ||

| IMOIC (Impact Multiple On Invested Capital) | Assumes a 50,000 USD cost per machine | 156,800 / 50,000 = 3.136 |

Use it to set diligence priorities by validating the baseline for PM₂.₅ and confirming mitigation options, confirming CO₂ durability and the accounting boundary (what is credited, and for how long), and verifying the income mechanismand who captures the value.

What the 1-hour workflow outputs (optional, high leverage): a one-page pathway summary, an assumptions register (what is known vs assumed), a driver-by-driver valuation table (like the one above), top diligence questions (e.g., top 5), and a simple sensitivity check (high/low for 2–3 key coefficients).

Two points are especially important for decision makers:

- The structure is transparent. Each line shows a KPI, a per-year metric, and the valuation logic. That makes it easy to challenge assumptions, stress-test coefficients, or refine baselines.

- The approach is deliberately simplified. As the note in the visual highlights, simplified methods may not fully capture potential negative impacts on main KPIs (e.g., GHG trade-offs). This is why rapid valuation should be treated as a screening tool—designed to identify materiality, magnitude, and key diligence questions.

How this changes impact management for investors and funds

When impact valuation becomes fast and repeatable, the role of impact management evolves:

- From periodic reporting to continuous decision support (screen, diligence, manage, exit)

- From bespoke analyses to standardized playbooks that ensure consistency across teams

- From “impact as narrative” to “impact as portfolio intelligence”—enabling comparisons, prioritization, and strategy optimization

It also strengthens collaboration between investment, ESG, and impact functions—because the outputs arrive in the same timeframe as investment committees and deal teams operate.

Moving forward: how Valuing Impact supports clients using AI

At Valuing Impact, we help clients adopt AI in a way that strengthens—not dilutes—credibility. In practice, that means:

- Optimizing prompts and building fit-for-purpose GPT workflows aligned to your strategy

- Training teams so AI use is consistent, auditable, and decision-relevant

- Setting up the impact framework and KPI architecture that makes fast valuation possible

- Defining how results will be used (screening thresholds, diligence triggers, IC integration, portfolio steering)

- Establishing data collection and verification pathways so rapid estimates can be progressively refined

AI can dramatically accelerate impact valuation. But the real breakthrough comes from combining speed with strong foundations: clear theory of change, disciplined KPIs, transparent valuation methods, and expert review. Done well, ultra-fast valuation becomes a practical lever for better investment decisions—and ultimately, better outcomes.