Impact valuation is the consistent, comparable, relevant and comprehensive approach to measuring and valuing an organization’s impact on society.

The results of running an impact evaluation are usually presented in an impact statement format, similar to financial reporting formatting, which allow companies to speak to a wide audience.

What it’ll enable you to do?

Understanding impact valuation

They are facing increasing reporting and disclosure requests. Their sustainability report becomes longer and longer each year. How can they make sense of the impact data and understand what matters when taking decisions?

Impact valuation and accounting solve this challenge by focusing the data on what is relevant to you. By expressing your indicators in monetary terms, they make your reporting comparable and comprehensive across all business activities.

We equip business and investors with data, insights and tools to measure, understand and act upon their impact on both society and nature.

And we’re here for you on this journey —accompanying, advising and guiding you every step of the way.

Definition of objectives, target stakeholders, and decision context. Clarification of boundaries: activities, geographies, time horizon and material impact areas. Understanding the decision making or strategic context in which the impact data will be used.

Design of an impact framework (a collection of impact pathways) from activities to outputs and outcomes across natural, social and human capital. Selection of valuation lenses and methods aligned with the your strategy.

Structuring your primary data requirements requirements and templates. Integration of secondary datasets and benchmarks to complete the impact evidence base.

Development of an impact valuation and accounting model using, for instance, the eQALY method and standardized templates. Quantification of impacts and scenarios results in a transparent, auditable structure.

Synthesis of key impact drivers, hotspots and trade-offs. Translation of results into actionable insights, strategic recommendations and clear visual outputs.

Identify which activities drive the greatest risk and value to the organization

Constantly improving our methodology and developing tools to provide better decision-making processes

Demonstrate the business relevance of sustainability performance and risks to investors by translating impact into financial value

Translate impact into credible, transparent and decision-relevant messages for internal and external stakeholders

Help set relevant sustainability targets and identify key performance indicators

Evaluate and measure impact trade-off across value chain to understand sourcing risk and impact

Guide strategic thinking and innovation by applying cutting-edge methodologies and the latest innovation and thinking in the field

Compare investment opportunities based on their social, environmental and business value. Support DD processes

Our comprehensive, open-source impact accounting system runs on bespoke methodology and integrates the data and analysis that will turn insights into a competitive advantage.

We built on the leading practice and protocol from the Capitals Coalition. Valuing Impact is a member of both their advisory board and their Impact Valuation Standard Board (IVSB).

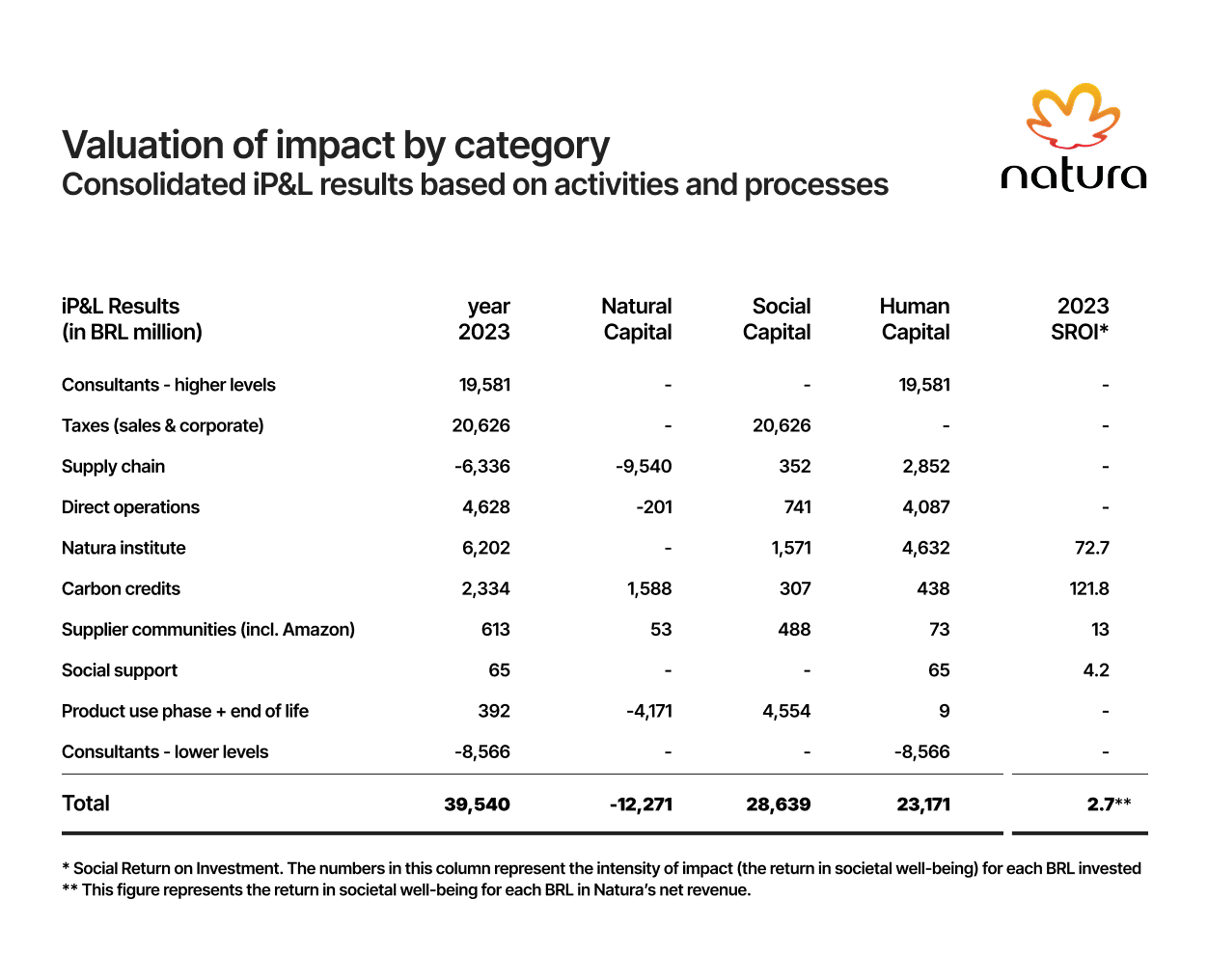

Natura Cosmetics, one of the world’s leading cosmetics brands worked with Valuing Impact and its eQALY impact valuation method to develop its full impact statement which was published on its investor relations website.

Featured Case Studies

By signing up to receive emails from Valuing Impact, you agree to our Privacy Policy. We treat your info responsibly. Unsubscribe anytime.